If you’re one of the 40 percent of Americans who made a financial New Year’s resolution this year, you already may be losing motivation.

The truth is that only 8 percent of people who make resolutions keep them. In fact, most have already given up by January 17, a date that’s unofficially known as “Ditch Your Resolution Day.”

You aren’t the problem. Your New Year’s resolution is.

If you started 2018 by simply vowing to be better with money – one of the common resolutions – then you basically set yourself up for failure. As the adage goes: A goal without a plan is just a wish.

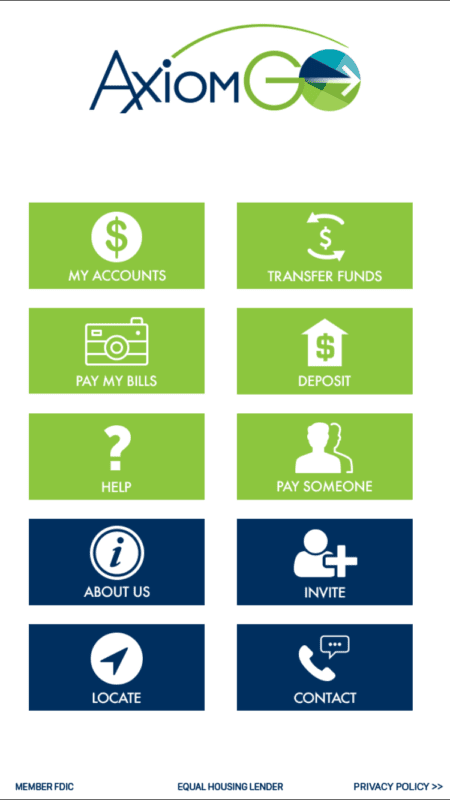

But it’s not too late. There’s a perfect tool to help you finally achieve your financial goals: AxiomGO, the new mobile-banking app that will help you become a better money manager.

Here’s a look at what can make AxiomGO a financial game-changer:

1. It’s easy to use.

1. It’s easy to use.

About 10 million Americans don’t have a checking account – and they may be spending extra moneyon check-cashing fees and dealing with the inconveniences of paying bills with cash or money orders.

AxiomGO makes it simple to fix that. You can open an account without ever visiting a brick-and-mortar bank. All you need to get started is a smartphone or tablet.

Need to deposit a check? You can do that right from AxiomGO, as well as pay your bills and transfer money to and from accounts at other banks.

Need to deposit a check? You can do that right from AxiomGO, as well as pay your bills and transfer money to and from accounts at other banks.

Telephone customer service is also available with AxiomGO, so you’re never totally flying solo.

2. AxiomGO can help you make – and stick to – a budget.

Two-thirds of Americans have no budget. Which means you’re likely one of them. And not having a budget means you may not have a good handle on where all your money is going.

Want to cruise the Mediterranean or hike the Grand Canyon? Maybe you’re hoping to buy a house or a car but need to build up a down payment. This is where budgeting isn’t just helpful, it’s necessary.

Use AxiomGO’s personal financial manager (PFM) to factor-in your income, and then set spending limits for various categories. The app’s spending alerts ping you when you’ve almost reached your limits, so you’ll know to slow down on non-essential spending.

Even better, your budget will help you stop worrying so much about having enough money to cover all your needs.

3. You’ll never overdraft again.

A 2014 survey by Pew Charitable Trusts found that 10 percent of people had paid an average of almost $70 in overdraft fees in the previous year.

With checkless checking, AxiomGO makes overdrafts a thing of the past.

Not only can you do all your banking online, but when there’s no money in your account to cover a transaction, the bank will simply decline the transaction.

Download AxiomGO now and make 2018 the year you finally take charge of your money and reach your financial goals.

Axiom Bank N.A, a nationally chartered community bank headquartered in Central Florida, provides retail banking services, including checking, deposit, and money market accounts. It also offers commercial banking services, treasury management services and commercial loans for real estate and business purposes.