Six Seasonal Tips for Holiday Budgeting

It’s that time of year when we look forward to visiting family and old friends, seeing colorful lights on every corner, and, yes, buying presents. Budgeting for the holidays can be a not-so-merry financial challenge, but following these six tips will save you money and stress in the coming weeks as you navigate holiday gift giving.

- Start early. You may scoff when you hear holiday jingles the day after Halloween, but it’s a good reminder to start planning your purchases. Although deals tend to pop up around Black Friday, it’s a good idea to have a solid handle on your shopping list so you can jump on a sale any time before Christmas Eve.

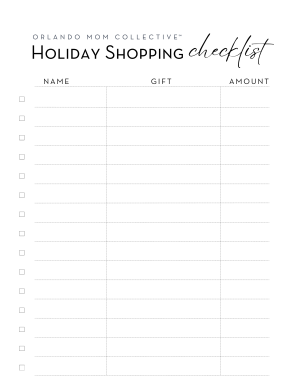

- Make a list and check it twice. Open your notebook, spreadsheet or checklist (like the one we have below) and list everyone you typically buy gifts for. Next to each name, estimate a dollar value that’s the maximum you’ll allow yourself to spend on that person. Every time you buy a new present, make a note. That way, you’ll never wind up shopping for someone you’ve already crossed off the list.

- Add a personal touch. For coworkers, neighbors, or distant relatives, consider going homemade. Hot cocoa mix, peppermint bark and cookies are all seasonal crowd-pleasers. Share them in a festive, creatively decorated jar, and include the recipe. Encourage group giving, like Secret Santa parties and white elephant exchanges, as a fun and frugal alternative to traditional gifts.

- Be precise with your holiday budgeting. Holiday costs range from big expenses, like charitable donations and airfare, to small ones, like wreaths, ornaments or gift bags. Be thrifty with shopping and take everything into account.

- Give thoughtfully, not recklessly. Generosity is part of the season, but it’s important to be realistic about how much you’re spending. Don’t let the festive spirit lull you into making an unwise purchase. Always keep your shopping list on hand, even when shopping online. Some websites are designed to lure you down the rabbit hole of impulse purchases. Instead of buying as you browse, save a link to the item and come back to it in a few days.

- Don’t spend beyond your means. Once the holiday glow wears off, you don’t want to devote January to paying off credit card debt. This is where a little advance planning reaps benefits in the long term.

It’s not impossible to make it through December with your budget intact, and you don’t need to feel like Scrooge while you do it. After all, the holidays aren’t about what you bring home from the store. By showing you care in big ways or small, you’re giving your family and friends the best possible gift.